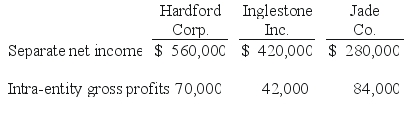

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-Compute the net income attributable to the noncontrolling interest in Ross for 2018.

A) $92,000.

B) $77,400.

C) $75,000.

D) $64,500.

E) $69,000.

Correct Answer:

Verified

Q21: Compute Lawrence's accrual-based net income for 2018.

A)

Q22: Hardford Corp. held 80% of Inglestone Inc.,

Q23: Q24: Hardford Corp. held 80% of Inglestone Inc., Q25: Compute Chase's accrual-based net income for 2018. Q27: Hardford Corp. held 80% of Inglestone Inc., Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

A)