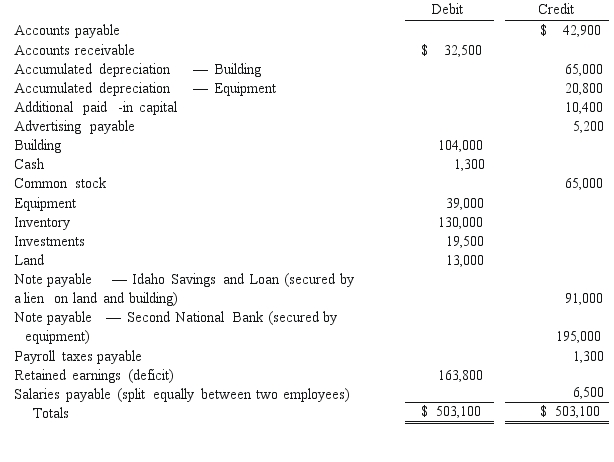

Mount Inc. was a hardware store that operated in Boise, Idaho. Management made some poor inventory acquisitions that loaded the store with unsalable merchandise. Due to the decline in revenues, the company became insolvent. Following is a trial balance as of March 15, 2018, the day the company filed forChapter 7 liquidation.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.

-How much cash would have been paid to an unsecured non-priority creditor who was owed a total of $1,300 by Mount Inc.? (Round the payout percentage to a whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Prepare a schedule to show the amount

Q49: Prepare a schedule to show the amount

Q49: Prepare a schedule to show the amount

Q56: Prepare a schedule to show the amount

Q68: Prepare a schedule to show the amount

Q69: How much will be paid to the

Q71: How much will Hampton's creditor of an

Q71: Prepare a Statement of Financial Affairs.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents