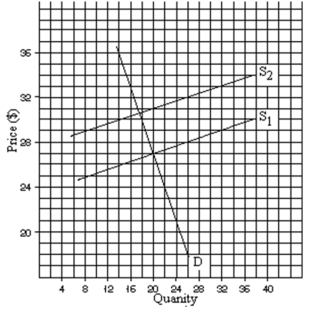

A.How much is the tax in the above graph?

B.How much of this tax is borne by the buyer and how much is borne by the seller?

C.As a result of the tax, by about how much does consumption fall?

Correct Answer:

Verified

(b) Buyer pay...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: The imposition of an excise tax on

Q188: When supply is perfectly elastic,the entire tax

Q193: Advertisers try to _ the demand for

Q200: If the price of chocolate goes up

Q201: The demand for Phillips gasoline is more

Q203: In the graph above, draw a supply

Q204: Draw another supply curve S to indicate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents