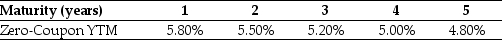

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The YTM of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

A) 5.5%

B) 5.8%

C) 5.5% .

D) 5.2%

Correct Answer:

Verified

Q44: If its YTM does not change,how does

Q61: Which of the following statements is false?

A)

Q62: Use the table for the question(s)below.

Consider the

Q63: The YTM of a 4-year default-free security

Q67: A 3-year default-free security with a face

Q71: Which of the following statements is false?

A)

Q73: Which of the following statements is false?

A)

Q78: Use the table for the question(s)below.

Consider the

Q78: A corporate bond which receives a BBB

Q80: Which of the following statements is false?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents