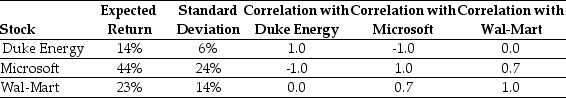

Use the table for the question(s) below.

Consider the following expected returns, volatilities, and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

A) 15%

B) 4%

C) 23%

D) 10%

Correct Answer:

Verified

Q46: Use the table for the question(s)below.

Consider the

Q46: Consider an equally weighted portfolio that contains

Q49: Which of the following statements is false?

A)

Q50: Which of the following statements is false?

A)

Q54: Which of the following statements is false?

A)

Q56: Use the table for the question(s)below.

Consider the

Q58: Use the table for the question(s)below.

Consider the

Q59: Which of the following statements is false?

A)

Q59: Use the table for the question(s)below.

Consider the

Q60: Which of the following statements is false?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents