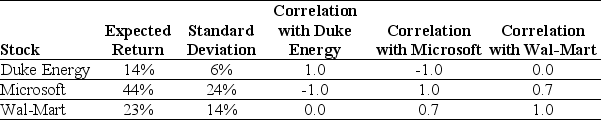

Use the table for the question(s) below.

Consider the following expected returns, volatilities, and correlations:

-The expected return of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

A) 21%

B) 12%

C) 27%

D) 18%

Correct Answer:

Verified

Q44: Use the table for the question(s)below.

Consider the

Q46: Consider an equally weighted portfolio that contains

Q48: Which of the following statements is FALSE?

A)We

Q49: Which of the following statements is FALSE?

A)

Q50: Which of the following statements is FALSE?

A)A

Q52: Use the table for the question(s) below.

Consider

Q53: Use the table for the question(s)below.

Consider the

Q56: Use the table for the question(s)below.

Consider the

Q57: Use the table for the question(s)below.

Consider the

Q59: Use the table for the question(s)below.

Consider the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents