Use the information for the question(s) below.

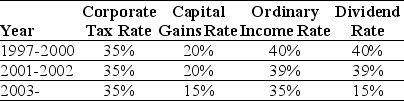

Consider the following tax rates:

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther has instead retained that cash permanently and invested it into treasury bills earning 6%,then the present value of the additional taxes paid by Luther would be closest to:

A) $35 million

B) $290 million

C) $175 million

D) $585 million

Correct Answer:

Verified

Q41: Which of the following statements is false?

A)

Q43: Use the following information to answer the

Q47: Use the following information to answer the

Q53: Net of ordinary income taxes,the amount that

Q58: Which of the following equations is incorrect?

A)

Q59: Which of the following statements is false?

A)

Q62: Consider the following equation:

Pretain = Pcum

Q65: Consider the following equation:

Pretain = Pcum

Q72: Use the information for the question(s)below.

Luther Industries

Q79: Use the information for the question(s)below.

Luther Industries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents