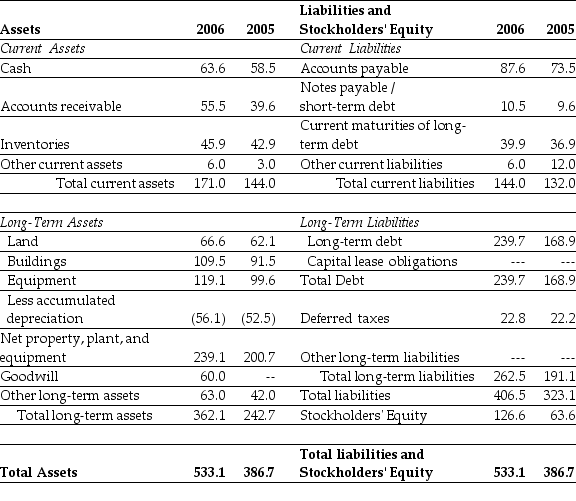

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

A) 0.39

B) 0.76

C) 1.29

D) 2.57

Correct Answer:

Verified

Q23: Use the table for the question(s) below.

Consider

Q24: Use the table for the question(s) below.

Consider

Q27: Which of the following statements regarding the

Q29: The debt-to-equity ratio is calculated by dividing

Q30: Firms disclose the potential for the dilution

Q31: Gross profit is calculated as _.

A) total

Q31: Creditors often compare a firm's _ and

Q32: By comparing a firm's current assets and

Q33: Use the table for the question(s) below.

Consider

Q35: Which of the following is NOT an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents