Use the information for the question(s) below.

Kinston Industries is considering investing in a machine that will cost $125,000 and will last for three years. The machine will generate revenues of $120,000 each year and the cost of goods sold will be 50% of sales. At the end of year three the machine will be sold for $15,000. The appropriate cost of capital is 10% and Kinston is in the 35% tax bracket.

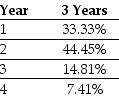

-Assume that Kinston's new machine will be depreciated using MACRS according to the following schedule:

What is the NPV of this project?

What is the NPV of this project?

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Use the information for the question(s)below.

The Sisyphean

Q49: Use the information for the question(s)below.

Temporary Housing

Q52: Assume that THSI's cost of capital for

Q57: Which of the following cash flows are

Q58: Which of the following statements is false?

A)

Q60: Which of the following statements is correct?

A)

Q63: Use the information for the question(s)below.

Kinston Industries

Q63: The depreciation tax shield for Shepard Industries

Q65: Use the information for the question(s) below.

Shepard

Q66: The free cash flow from Shepard Industries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents