Use the information for the question(s) below.

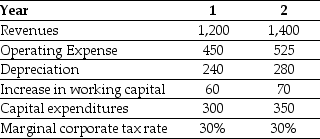

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions of dollars) .

-The incremental unlevered net income for Shepard Industries in year two is closest to:

A) $355 million

B) $415 million

C) $600 million

D) $510 million

Correct Answer:

Verified

Q48: The NPV for Epiphany's Project is closest

Q49: Use the information for the question(s)below.

Temporary Housing

Q54: Use the information for the question(s)below.

The Sisyphean

Q56: You are considering investing $600,000 in a

Q57: Use the information for the question(s)below.

Epiphany Industries

Q68: The most difficult part of capital budgeting

Q69: The depreciation tax shield for Shepard Industries

Q70: The free cash flow from Shepard Industries

Q76: To calculate other non-cash items,a firm adds

Q77: Luther Industries has outstanding tax loss carryforwards

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents