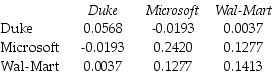

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6,000 investment in Duke Energy stock and a $4,000 investment in Wal-Mart stock is closest to:

A) 0.050

B) 0.045

C) 0.051

D) -0.020

Correct Answer:

Verified

Q24: Which of the following equations is incorrect?

A)

Q25: The risk of a portfolio depends on

Q26: Which of the following statements is false?

A)

Q27: Use the table for the question(s) below.

Consider

Q28: Use the table for the question(s) below.

Consider

Q30: Use the table for the question(s) below.

Consider

Q31: Use the table for the question(s) below.

Consider

Q32: Use the table for the question(s) below.

Consider

Q33: Use the table for the question(s) below.

Consider

Q34: Which of the following statements is false?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents