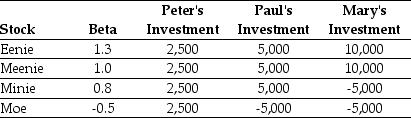

Use the table for the question(s) below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Paul's portfolio is closest to:

A) 20%

B) 22%

C) 18%

D) 16%

Correct Answer:

Verified

Q47: If the market portfolio is efficient,the relationship

Q49: Which of the following statements is false?

A)

Q50: Which of the following statements is false?

A)

Q53: Which of the following statements is false?

A)

Q114: The beta for the market portfolio is

Q120: The beta for the risk-free investment is

Q122: Use the information for the question(s)below.

Suppose that

Q124: Use the table for the question(s)below.

Consider the

Q127: Use the information for the question(s)below.

Suppose that

Q130: Use the information for the question(s)below.

Suppose that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents