Josh Drake died on May 1,2011.He left his entire estate,with a fair value of $6,200,000 to his sole surviving family member,his daughter,DeeDee.

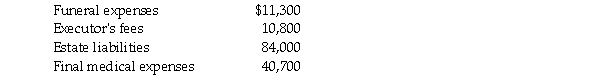

Prior to any distribution of assets,Josh's estate reflected the following details:

Required:

Required:

Calculate the federal estate tax on Mr.Drake's estate.You may ignore any state-level inheritance taxes and assume that the federal estate tax rate is 45%.

Correct Answer:

Verified

Q22: Warren Peace passed away,with his will leaving

Q23: John Doe's will states that all assets

Q25: Rusty Nail died in the summer of

Q27: Mason Dixon dies on November 30,2011,leaving a

Q29: Suzanne Quincy passed away on October 25,2011.Suzanne

Q30: Richard Stands passed away at on September

Q31: Cindy Lou's parents passed away while she

Q31: Silvia Peacock has been appointed to serve

Q32: Avery died testate early in 2011.The following

Q33: Oscar Lloyd is serving as the executor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents