Use the following information to answer the question(s) below.

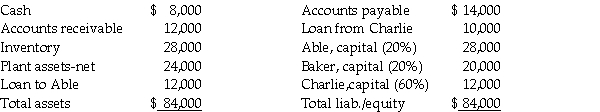

On June 30,2011,the Able,Baker,and Charlie partnership had the following fiscal year-end balance sheet:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

* Receivables of $6,000 were collected.

* All inventory was sold for $8,000.

* All available cash was distributed on July 31,except for

$4,000 that was set aside for contingent expenses.

-The book value of the partnership equity (i.e. ,total equity of the partners) on June 30,2011 is

A) $ 58,000.

B) $ 60,000.

C) $ 84,000.

D) $120,000.

Correct Answer:

Verified

Q2: Which statement is correct in describing the

Q5: Q6: In partnership liquidations,what are safe payments? Q11: Q15: Que,Rae,and Sye are in the process of Q17: Which partner is considered the most vulnerable Q21: The Catt,Dogg,and Eustus partnership was dissolved by Q22: Tye,Ula,Val,and Watt are partners who share profits Q23: Eve,Fig,Gus,and Hal are partners who share profits Q24: The balance sheet of the partnership of![]()

A)The amounts![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents