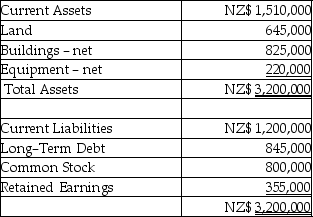

Par Industries,a U.S.Corporation,purchased Slice Company of New Zealand for $1,411,800 on January 1,2011.Slice's functional currency is the New Zealand dollar (NZ$).Slice's books are kept in NZ$.The book values of Slice's assets and liabilities were equal to fair values,with the exception of land which was valued at NZ$1,300,000.Slice's balance sheet appears below:

Relevant exchange rates are shown below:

Relevant exchange rates are shown below:

January 1,2011 1 NZ$ = $0.78

Average rate 2011 1 NZ$ = $0.79

December 31,2011 1 NZ$ = $0.80

Required:

Determine the unrealized translation gain or loss at December 31,2011 relating to the excess allocated to the undervalued land.

Correct Answer:

Verified

Q1: A U.S.firm has a Belgian subsidiary that

Q5: A foreign subsidiary's accounts receivable balance should

Q18: The following assets of Poole Corporation's Romanian

Q21: For each of the 12 accounts listed

Q22: Phim Inc. ,a U.S.company,owns 100% of Sera

Q24: Each of the following accounts has been

Q25: On January 1,2011,Pilgrim Corporation,a U.S.firm,acquired ownership of

Q26: Pan Corporation,a U.S.company,formed a British subsidiary on

Q27: Plate Corporation,a US company,acquired ownership of Saucer

Q28: Note to Instructor: This exam item is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents