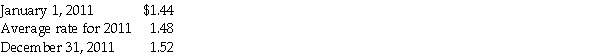

On January 1,2011,Paste Unlimited,a U.S.company,acquired 100% of Sticky Corporation of Italy,paying an excess of 112,500 euros over the book value of Sticky's net assets.The excess was allocated to undervalued equipment with a five year remaining useful life.Sticky's functional currency is the euro,and the books are kept in euros.Exchange rates for the euro for 2011 are:

Required:

Required:

1.Determine the depreciation expense on the excess allocated to equipment for 2011 in U.S.dollars.

2.Determine the unamortized excess allocated to equipment on December 31,2011 in U.S.dollars.

3.If Sticky's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2011?

Correct Answer:

Verified

Depreciation expense in 20...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: On January 1,2012,Planet Corporation,a U.S.company,acquired 100% of

Q30: Puddle Incorporated purchased an 80% interest in

Q31: Note to Instructor: This exam item is

Q32: Note to Instructor: This exam item is

Q33: On January 1,2011,Psalm Corporation purchased all the

Q34: Pritt Company purchased all the outstanding stock

Q35: Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a

Q36: On January 1,2011,Placid Corporation acquired a 40%

Q37: Pew Corporation (a U.S.corporation)acquired all of the

Q39: Plato Corporation,a U.S.company,purchases all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents