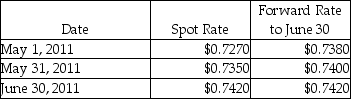

On May 1,2011,Listing Corporation receives inventory items from their Bulgarian supplier.At the same time,Listing signed a forward contract to purchase 75,000 Bulgarian lev in sixty days to hedge the inventory purchase at $0.738,the 60-day forward rate.Payment for the inventory will be due in sixty days in Bulgarian lev.Assume the forward contract will be settled net and this qualifies as a fair value hedge.The related exchange rates are shown below:  Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on May 31?

Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on May 31?

A) $150 asset

B) $150 liability

C) $375 asset

D) $375 liability

Correct Answer:

Verified

Q1: Which of the following is not an

Q1: Use the following information to answer the

Q9: Use the following information to answer the

Q11: International accounting standards differ from U.S.Generally Accepted

Q12: When preparing their year-end financial statements,the Warner

Q13: Use the following information to answer the

Q16: Use the following information to answer the

Q17: Which of the following hedging strategies would

Q19: Use the following information to answer the

Q20: When a cash flow hedge is appropriate,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents