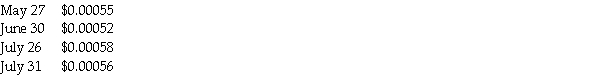

Tank Corporation,a U.S.manufacturer,has a June 30 fiscal year end.Tank sold goods to their customer in Columbia on May 27,2011 for 18,000,000 Columbian pesos.The customer agreed to pay pesos in 60 days.When the customer wired the funds to Tank on July 26,Tank held them in their bank account until July 31 before selling them and converting them to U.S.dollars.The following exchange rates apply:

Required:

Required:

Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following statements is true

Q2: Use the following information to answer the

Q6: Ulysses Company purchases goods from China amounting

Q13: If a U.S.company is preparing a journal

Q21: Plymouth Corporation (a U.S.company)began operations on September

Q23: On October 15,2011,Napole Corporation,a French company,ordered merchandise

Q24: Johnson Corporation (a U.S.company)began operations on December

Q25: Charin Corporation,a U.S.corporation,imports and exports small electronics.On

Q26: On November 1,2010,the Yankee Corporation,a US corporation,purchased

Q27: Blue Corporation,a U.S.manufacturer,sold goods to their customer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents