Use the following information to answer the question(s) below.

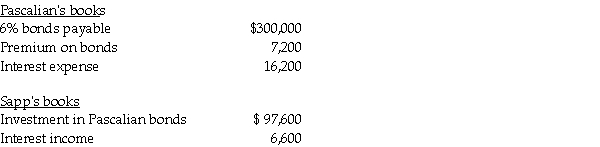

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-The gain from the bond purchase that appeared on the December 31,2010 consolidated income statement was

A) $4,320.

B) $4,800.

C) $5,400.

D) $6,000.

Correct Answer:

Verified

Q4: Use the following information to answer the

Q5: Use the following information to answer the

Q6: Use the following information to answer the

Q6: No constructive gain or loss arises from

Q8: Use the following information to answer the

Q9: Use the following information to answer the

Q10: Use the following information to answer the

Q11: Use the following information to answer the

Q12: Use the following information to answer the

Q14: If an affiliate purchases bonds in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents