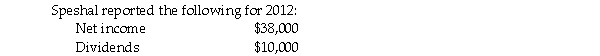

Phlora purchased its 100% ownership in Speshal many years ago at a time when book values of assets and liabilities equaled market values.

On January 2,2012,Phlora purchased $200,000 of Speshal Corporation's 6% bonds for $182,000.At that time,this was all of the bonds that had been issued by Speshal,and unamortized premium on Speshal's books was $3,500.The bonds pay interest on July 1 and January 1 and mature on January 1,2017.Both Phlora and Speshal use straight-line amortization.Phlora uses the equity method of accounting for its investment in Speshal.

Required:

Required:

Prepare elimination/adjusting entries on the consolidating work papers for the year ended December 31,2012.

Correct Answer:

Verified

Q21: Popcorn Corporation owns 90% of the outstanding

Q22: Peter Corporation owns a 70% interest in

Q23: Separate company and consolidated income statements for

Q24: Pachelor Corporation owns 70% of the outstanding

Q25: Paleo Corporation holds 80% of the capital

Q27: Pongo Company has $2,000,000 of 6% bonds

Q28: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q29: Pare Corporation owns 65% of the outstanding

Q30: Pheasant Corporation owns 80% of Sal Corporation's

Q31: Spott is a 75%-owned subsidiary of Penthal.On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents