On December 31,2010,Patenne Incorporated Purchased 60% of Smolin Manufacturing for $300,000.The

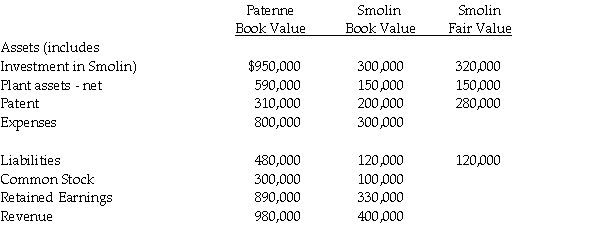

On December 31,2010,Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000.The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years,and a patent which was undervalued by $40,000 and had a remaining life of 5 years.At December 31,2012,the companies showed the following balances on their respective adjusted trial balances:

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2012.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2012.

Requirement 2: Calculate consolidated net income for 2012,and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31,2012.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: When preparing consolidated financial statements,which of the

Q20: At the beginning of 2011,Parling Food Services

Q21: Pommu Corporation paid $78,000 for a 60%

Q22: Flagship Company has the following information collected

Q23: Pecan Incorporated acquired 80% of the voting

Q25: Pull Incorporated and Shove Company reported summarized

Q26: Pawl Corporation acquired 90% of Snab Corporation

Q27: Parrot Corporation acquired 90% of Swallow Co.on

Q28: Puddle Corporation acquired all the voting stock

Q29: Powell Corporation acquired 90% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents