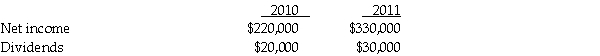

Pancake Corporation saw the potential for vertical integration and purchases a 15% interest in Syrup Corp.on January 1,2010,for $150,000.At that date,Syrup's stockholders' equity included $200,000 of $10 par value common stock,$300,000 of additional paid in capital,and $500,000 retained earnings.The companies began to work together and realized improved sales by both parties.On December 31,2011,Pancake paid $250,000 for an additional 20% interest in Syrup Corp.Both of Pancake's investments were made when Syrup's book values equaled their fair values.Syrup's net income and dividends for 2010 and 2011 were as follows:

Required:

Required:

1.Prepare journal entries for Pancake Corporation to account for its investment in Syrup Corporation for 2010 and 2011.

2.Calculate the balance of Pancake's investment in Syrup at December 31,2011

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: On January 1,2010,Palgan,Co.purchased 75% of the outstanding

Q31: Keynse Company owns 70% of Subdia Incorporated.The

Q32: Shebing Corporation had $80,000 of $10 par

Q33: On January 1,2011,Pailor Inc.purchased 40% of the

Q34: Firms must conduct impairment tests more frequently

Q34: Shoreline Corporation had $3,000,000 of $10 par

Q35: For 2010 and 2011,Sabil Corporation earned net

Q38: Pearl Corporation paid $150,000 on January 1,2010

Q39: On January 1,2010,Petrel,Inc.purchased 70% of the outstanding

Q40: For 2010,2011,and 2012,Squid Corporation earned net incomes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents