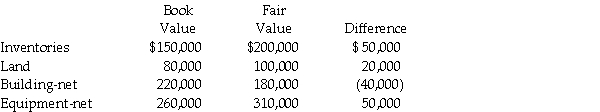

Paster Corporation was seeking to expand its customer base,and wanted to acquire a company in a market area it had not yet served.Paster determined that the Semma Company was already in the market they were pursuing,and on January 1,2011,purchased a 25% interest in Semma to assure access to Semma's customer base.Paster paid $800,000,at a time when the book value of Semma's net equity was $3,000,000.Semma's book values equaled their fair values except for the following items:

Required:

Required:

Prepare a schedule to allocate any excess purchase cost to identifiable assets and goodwill.

Correct Answer:

Verified

Schedule...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: In reference to the determination of goodwill

Q11: Which one of the following statements is

Q18: The income from an equity method investee

Q19: Jabiru Corporation purchased a 20% interest in

Q20: What method of accounting will generally be

Q22: On January 1,2011,Pendal Corporation purchased 25% of

Q23: Stilt Corporation purchased a 40% interest in

Q24: Plum Corporation paid $700,000 for a 40%

Q25: Pike Corporation paid $100,000 for a 10%

Q26: Wader's Corporation paid $120,000 for a 25%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents