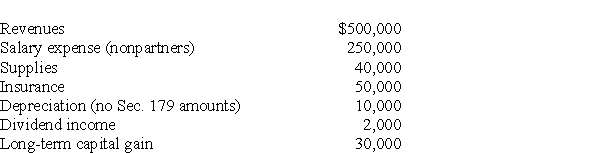

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: What are the three rules and their

Q43: Identify which of the following statements is

Q46: The XYZ Partnership is held by ten

Q47: Matt and Joel are equal partners in

Q48: Explain the tax consequences for both the

Q49: Does the contribution of services to a

Q50: The WE Partnership reports the following items

Q53: Dinia has agreed to provide services valued

Q58: In computing the ordinary income of a

Q60: Mary and Martha, who had been friends

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents