Prime Corporation liquidates its 85%-owned subsidiary Bass Corporation under the provisions of Secs.332 and 337.Bass Corporation distributes land to its minority shareholder,John,who owns a 15% interest.The property received by John has a $55,000 FMV.The land was used in the Bass Corporation's business and has a $65,000 adjusted basis and is subject to a $10,000 liability,which is assumed by John.John's basis in his stock is $25,000.What gain or loss will John and Bass Corporation recognize on the distribution of the land?

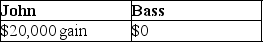

A)

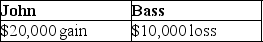

B)

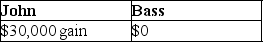

C)

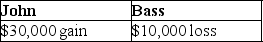

D)

Correct Answer:

Verified

Q45: Explain the difference in tax treatment between

Q51: Specialty Corporation distributes land to one of

Q59: Dusty Corporation owns 90% of Palace Corporation's

Q63: The general rule for tax attributes of

Q65: Parent Corporation owns 100% of the stock

Q68: Lake City Corporation owns all the stock

Q69: In a Sec. 332 liquidation, can a

Q73: Greg, a cash method of accounting taxpayer,

Q75: In a Sec. 332 liquidation, what bases

Q80: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents