Homewood Corporation adopts a plan of liquidation on June 15 and shortly thereafter sells a parcel of land on which it realizes a $50,000 gain (excluding the effects of a $5,000 sales commission) .Homewood pays its legal counsel $2,000 to draft the plan of liquidation.The accountant fees for the liquidation are $1,000,which are also paid during the year.What is Homewood Corporation's realized gain on the sale of land and deductible liquidation expenses?

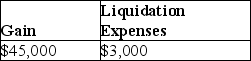

A)

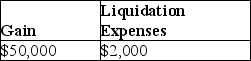

B)

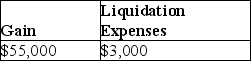

C)

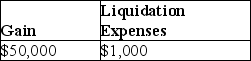

D)

Correct Answer:

Verified

Q71: What are the differences, if any, in

Q76: What basis do both the parent and

Q79: Parent Corporation owns 80% of the stock

Q81: A corporation is required to file Form

Q84: Jack has a basis of $36,000 in

Q84: If a liquidating subsidiary corporation primarily has

Q86: Santa Fe Corporation adopts a plan of

Q88: Why should a corporation that is 100%

Q93: Parent Corporation owns all of Subsidiary Corporation's

Q97: What are the tax consequences of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents