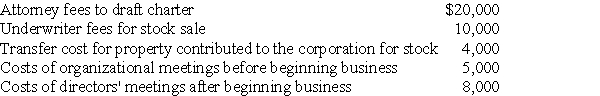

The following expenses are incurred by Salter Corporation when it is organized on July 1:

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Richards Corporation has taxable income of $280,000

Q31: Identify which of the following statements is

Q33: Identify which of the following statements is

Q34: Organizational expenditures include all of the following

Q42: Identify which of the following statements is

Q43: Money Corporation has the following income and

Q49: Jackson Corporation, not a dealer in securities,

Q52: Identify which of the following statements is

Q52: Identify which of the following statements is

Q59: Chambers Corporation is a calendar year taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents