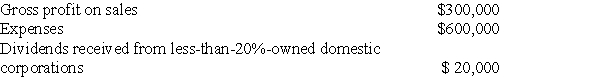

Courtney Corporation had the following income and expenses for the tax year:

Courtney had taxable income for the past three years of:

Courtney had taxable income for the past three years of:

a)Determine the corporation's NOL for the current year.

a)Determine the corporation's NOL for the current year.

b)Determine the amount of NOL carried back to each preceding tax year and the amount of NOL,if any,available as a carryforward.

Correct Answer:

Verified

Q63: Little Corporation uses the accrual method of

Q66: How does the use of an NOL

Q73: Carter Corporation reports the following results for

Q73: Vanda Corporation sold a truck with an

Q74: Jackel,Inc.has the following information for the current

Q75: For corporations, what happens to excess charitable

Q76: Chase Corporation reports the following results in

Q76: When computing corporate taxable income, what is

Q77: What impact does an NOL carryforward have

Q78: Francine Corporation reports the following income and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents