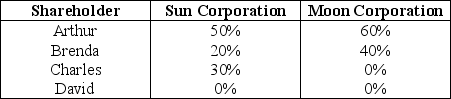

Sun and Moon Corporations each have only one class of stock outstanding.Their stock ownership is shown below.  Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50% requirements? (Assume the two corporations are equally valued.)

Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50% requirements? (Assume the two corporations are equally valued.)

A) No stock ownership change is required.

B) Arthur sells 4/5ths of his shares in Sun to David.

C) Arthur sells his 2/3rds of his shares to David.

D) Arthur must acquire an additional 30% of Moon Corporation.

Correct Answer:

Verified

Q82: Identify which of the following statements is

Q82: Quality Corporation, a regular corporation, has an

Q84: Access Corporation,a large manufacturer,has a taxable income

Q92: Zeta Corporation received a $150,000 dividend from

Q93: Westwind Corporation reports the following results for

Q93: All of the taxable income of a

Q95: Cricket Corporation has a $50,000 NOL in

Q97: Woods and Tiger Corporations have only one

Q98: Sun and Moon Corporations each have only

Q100: Delux Corporation,a retail sales corporation,has a taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents