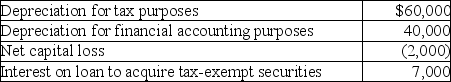

Winter Corporation's taxable income is $500,000.In addition,Winter has the following items:  What is Winter's financial accounting income?

What is Winter's financial accounting income?

A) $511,000

B) $513,000

C) $518,000

D) $520,000

Correct Answer:

Verified

Q83: Identify which of the following statements is

Q85: What is probably the most common reason

Q92: Zeta Corporation received a $150,000 dividend from

Q98: Sun and Moon Corporations each have only

Q100: Delux Corporation,a retail sales corporation,has a taxable

Q108: A deferred tax asset indicates that a

Q112: Which of the following results in a

Q113: Junod Corporation's book income is $500,000. What

Q114: Deferred tax liabilities occur when expenses are

Q116: Jeffrey Corporation has asked you to prepare

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents