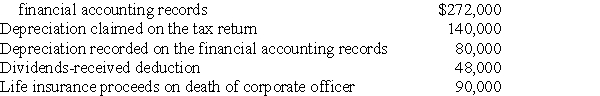

Exam Corporation reports taxable income of $800,000 on its federal income tax return.Given the following information from the corporation's records,determine its book income.

Deduction for federal income taxes per

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: What are some of the advantages and

Q94: You are the CPA who prepares the

Q96: Beta Corporation recently purchased 100% of XYZ

Q97: Identify which of the following statements is

Q100: Corporate estimated tax payments are due April

Q101: Which of the following items is a

Q107: Discuss the estimated tax filing requirements for

Q113: Dreyfuss Corporation reports the following items:

Q114: Grant Corporation is not a large corporation

Q117: Bishop Corporation reports taxable income of $700,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents