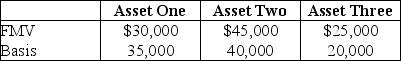

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.  Max's recognized gain is

Max's recognized gain is

A) $3,000.

B) $5,000.

C) $7,000.

D) $10,000.

Correct Answer:

Verified

Q41: Sarah transfers property with an $80,000 adjusted

Q42: Jeremy transfers Sec. 351 property acquired three

Q45: Ralph transfers property with an adjusted basis

Q49: Carmen and Marc form Apple Corporation. Carmen

Q51: The transferor's holding period for any stock

Q53: Jerry transfers two assets to a corporation

Q54: Carolyn transfers property with an adjusted basis

Q57: Identify which of the following statements is

Q58: Matt and Sheila form Krupp Corporation. Matt

Q60: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents