Instruction 3-1

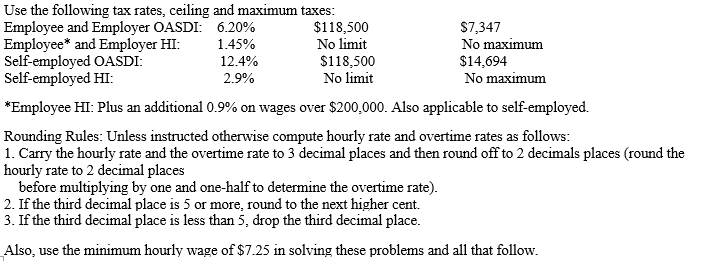

-Refer to Instruction 3-1.Crow earned $585.15 during the week ended March 1,20--.Prior to payday,Crow had cumulative gross earnings of $4,733.20.

a)The amount of OASDI taxes to withhold from Crow's pay is __________.

b)The amount of HI taxes to withhold from Crow's pay is __________.

Correct Answer:

Verified

Q42: The OASDI taxable wage base is correctly

Q43: Ashe,an employer,has made timely deposits of FICA

Q44: Each of the following items is accurately

Q46: Form 941 is due on or before

Q48: Form 944 (annual form) can be used

Q51: If an employer fails to file an

Q53: The taxes imposed under the Social Security

Q57: FICA defines all of the following as

Q58: Employers file Form 941 with the IRS

Q59: FICA defines all of the following as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents