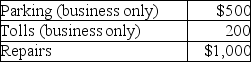

Chelsea,who is self-employed,drove her automobile a total of 20,000 business miles in 2017.This represents about 75% of the auto's use.She has receipts as follows:

Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

A) $11,400.

B) $12,400.

C) $10,700.

D) $11,700.

Correct Answer:

Verified

Q15: A three- day investment conference is held

Q21: Taxpayers may use the standard mileage rate

Q22: Transportation expenses incurred to travel from one

Q24: Rui,a CPA,is employed by a firm with

Q31: Norman traveled to San Francisco for four

Q32: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q33: Ron is a university professor who accepts

Q33: Commuting to and from a job location

Q34: If the standard mileage rate is used

Q36: Gwen traveled to New York City on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents