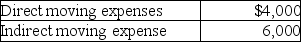

Edward incurs the following moving expenses:

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Q46: In-home office expenses are deductible if the

Q57: An employer contributing to a qualified retirement

Q62: Josiah is a human resources manager of

Q65: All of the following statements regarding tax

Q68: Employees receiving nonqualified stock options recognize ordinary

Q69: Which of the following situations will disqualify

Q74: A sole proprietor establishes a Keogh plan.The

Q75: All of the following may deduct education

Q79: Ellie,a CPA,incurred the following deductible education expenses

Q80: Ron obtained a new job and moved

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents