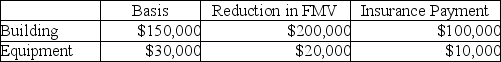

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

A) $54,900

B) $60,000

C) $70,000

D) $180,000

Correct Answer:

Verified

Q55: An individual is considered to materially participate

Q61: Which of the following is most likely

Q65: When the taxpayer anticipates a full recovery

Q70: When business property involved in a casualty

Q71: Nicole has a weekend home on Pecan

Q73: A theft loss is deducted in the

Q76: A fire totally destroyed office equipment and

Q78: Leonard owns a hotel which was damaged

Q192: Why did Congress enact restrictions and limitations

Q199: What is required for an individual to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents