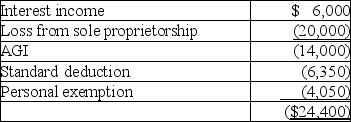

Kayla reported the following amounts in her 2017 tax return:

Kayla has generated an NOL of

A) $0.

B) ($24,350) .

C) ($14,000) .

D) ($20,000) .

Correct Answer:

Verified

Q86: Vera has a key supplier for her

Q87: A net operating loss can be carried

Q106: A taxpayer incurs a net operating loss

Q108: An individual taxpayer has negative taxable income

Q111: A taxpayer's home is destroyed by fire,resulting

Q112: Harley,a single individual,provided you with the following

Q117: Martha,an accrual-method taxpayer,has an accounting practice.In 2016,she

Q118: Frank loaned Emma $5,000 in 2015 with

Q229: What are some factors which indicate that

Q232: If a loan has been made to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents