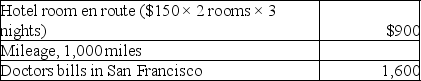

In 2017,Sela traveled from her home in Flagstaff to San Francisco to seek specialized medical care.Because she was unable to travel alone,her father accompanied her.Total expenses included:

The total medical expenses deductible before the 10% limitation are

A) $1,600.

B) $2,070.

C) $2,500.

D) $2,670.

Correct Answer:

Verified

Q1: Capital expenditures incurred for medical purposes which

Q2: Medical expenses paid on behalf of an

Q3: Due to stress on the job,taxpayer Fiona

Q6: Jeffrey,a T.V.news anchor,is concerned about the wrinkles

Q7: If a prepayment is a requirement for

Q9: Leo spent $6,600 to construct an entrance

Q11: The definition of medical care includes preventive

Q12: Medical expenses are deductible as a from

Q13: In order for a taxpayer to deduct

Q20: Expenditures incurred in removing structural barriers in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents