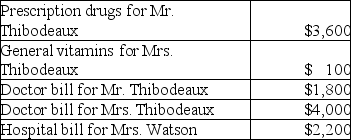

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

A) $1,900

B) $2,000

C) $4,100

D) $9,400

Correct Answer:

Verified

Q22: In 2017,Carlos filed his 2016 state income

Q24: A review of the 2017 tax file

Q27: Mr.and Mrs.Gere,who are filing a joint return,have

Q28: Alan,who is a security officer,is shot while

Q30: Linda had a swimming pool constructed at

Q30: Mitzi's medical expenses include the following:

Q31: The following taxes are deductible as itemized

Q31: Caleb's medical expenses before reimbursement for the

Q38: Assessments or fees imposed by the government

Q266: Explain under what circumstances meals and lodging

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents