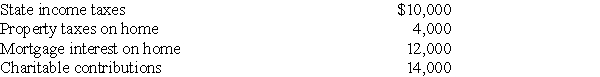

Tasneem,a single taxpayer has paid the following amounts in 2017:

Tasneem's AGI is $363,500.What is her net itemized deduction allowed?

A) $40,000

B) $38,800

C) $36,940

D) $32,730

Correct Answer:

Verified

Q83: Carol contributes a painting to a local

Q85: Hugh contributes a painting to a local

Q86: Corner Grocery,Inc.,a C corporation with high taxable

Q98: Marcia,who is single,finished graduate school this year

Q102: What is the result if a taxpayer

Q104: Beth and Sajiv,a married couple,earned AGI of

Q107: Legal fees for drafting a will are

Q116: Patrick's records for the current year contain

Q347: Jorge contributes $35,000 to his church and

Q352: What is the treatment of charitable contributions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents