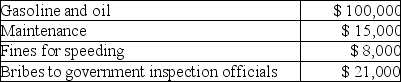

Jimmy owns a trucking business.During the current year he incurred the following:

The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordinary in the industry.What is the total amount of deductible expenses?

A) $115,000

B) $123,000

C) $108,000

D) $144,000

Correct Answer:

Verified

Q27: Interest expense on debt incurred to purchase

Q38: A sole proprietor contributes to the election

Q40: Kickbacks and bribes paid to federal officials

Q44: Business investigation expenses incurred by a taxpayer

Q46: Kaitlyn owns a hotel in Phoenix,Arizona.The Arizona

Q49: Taxpayers may deduct lobbying expenses incurred to

Q50: Kaitlyn owns a hotel in Phoenix,Arizona.The city

Q53: Which of the following factors is important

Q57: Emeril borrows $340,000 to finance taxable and

Q59: A taxpayer opens a new business this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents