Chana purchased 400 shares of Tronco Corporation stock for $40,000 in 2014.On December 27,2017,Chana sells the 400 shares for $24,000.Chana purchases 300 shares of Tronco Corporation stock on January 16,2018 for $8,000.Chana's recognized loss on sale of the 400 shares in 2017 and her basis in her 300 new shares are

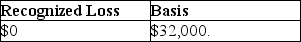

A)

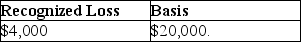

B)

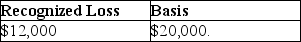

C)

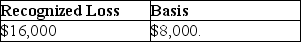

D)

Correct Answer:

Verified

Q87: The term "principal place of business" includes

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q104: Expenses attributable to the rental use of

Q105: Nikki is a single taxpayer who owns

Q106: Dana purchased an asset from her brother

Q108: Hobby expenses are deductible as for AGI

Q113: Sheila sells stock,which has a basis of

Q115: Jason sells stock with an adjusted basis

Q121: Mackensie owns a condominium in the Rocky

Q486: Explain the rules for determining whether a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents