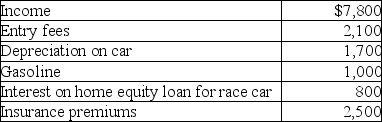

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

A) $0

B) $300

C) $1,400

D) $1,700

Correct Answer:

Verified

Q108: The Super Bowl is played in Tasha's

Q123: Juanita knits blankets as a hobby and

Q125: Anita has decided to sell a parcel

Q127: Lloyd purchased 100 shares of Gold Corporation

Q129: Ola owns a cottage at the beach.She

Q133: For the years 2013 through 2017 (inclusive)Max,a

Q135: Abigail's hobby is sculpting.During the current year,Abigail

Q136: For the years 2013 through 2017 (inclusive)Mary,a

Q137: Margaret,a single taxpayer,operates a small pottery activity

Q481: Diane, a successful accountant with an annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents