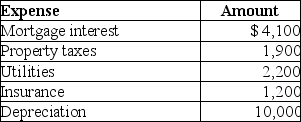

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

A) $ 5,074.

B) $ 8,515.

C) $ 7,900.

D) $10,000.

Correct Answer:

Verified

Q121: All of the following deductible expenses are

Q123: Juanita knits blankets as a hobby and

Q124: Gabby owns and operates a part-time art

Q126: Brent must substantiate his travel and entertainment

Q128: Vanessa owns a houseboat on Lake Las

Q136: For the years 2013 through 2017 (inclusive)Mary,a

Q137: Margaret,a single taxpayer,operates a small pottery activity

Q141: In 2017 the IRS audits a company's

Q483: During the current year, Jack personally uses

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents