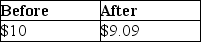

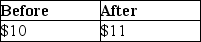

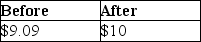

Dustin purchased 50 shares of Short Corporation for $500.During the current year,Short declared a nontaxable 10% stock dividend.What is the basis per share before and after the stock dividend is distributed?

A)

B)

C)

D)

Correct Answer:

Verified

Q44: Melody inherited 1,000 shares of Corporation Zappa

Q47: Brad owns 100 shares of AAA Corporation

Q48: Monte inherited 1,000 shares of Corporation Zero

Q49: David gave property with a basis of

Q56: During the current year,Don's aunt Natalie gave

Q56: Jamahl and Indira are married and live

Q63: Joy purchased 200 shares of HiLo Mutual

Q65: All of the following are capital assets

Q70: Bad debt losses from nonbusiness debts are

Q572: Distinguish between the Corn Products doctrine and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents