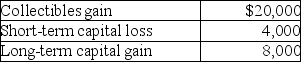

Kendrick,who has a 33% marginal tax rate,had the following results from transactions during the year:

After offsetting the STCL,what is (are) the resulting gain(s) ?

A) $16,000 collectibles gain, $8,000 LTCG

B) $20,000 collectibles gain, $4,000 LTCG

C) $24,000 LTCG

D) $20,000 collectibles gain, $8,000 LTCG

Correct Answer:

Verified

Q88: Candice owns a mutual fund that reinvests

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q104: Jade is a single taxpayer in the

Q106: During the current year,Nancy had the following

Q107: Gertie has a NSTCL of $9,000 and

Q108: Tina,whose marginal tax rate is 33%,has the

Q110: Mike sold the following shares of stock

Q114: Chen had the following capital asset transactions

Q118: Abra Corporation generated $100,000 of taxable income

Q118: Maya expects to report about $2 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents