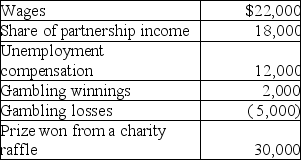

Lori had the following income and losses during the current year:

What is Lori's adjusted gross income?

A) $72,000

B) $79,000

C) $82,000

D) $84,000

Correct Answer:

Verified

Q61: Which of the following is not included

Q81: Julia,age 57,purchases an annuity for $33,600.Julia will

Q86: Bridget owns 200 shares of common stock

Q88: David,age 62,retires and receives $1,000 per month

Q91: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q100: Thomas purchased an annuity for $20,000 that

Q105: While using a metal detector at the

Q109: In addition to Social Security benefits of

Q109: Lily had the following income and losses

Q116: Sheryl is a single taxpayer with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents