Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land.The partnership had purchased the land five years ago for $20,000,but it is worth $28,000 at the time of the distribution.Ariel's predistribution basis is $17,000.How much income will Ariel recognize due to the distribution,and what is her basis in the land?

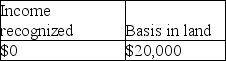

A)

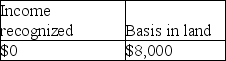

B)

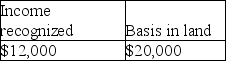

C)

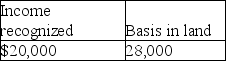

D)

Correct Answer:

Verified

Q41: Sari transferred an office building with a

Q42: Chen contributes a building worth $160,000 (adjusted

Q49: Lance transferred land having a $180,000 FMV

Q58: Emma contributes property having a $24,000 FMV

Q60: John contributes land having $110,000 FMV and

Q65: Rowan and Sanjay are equal partners in

Q66: Joey and Bob each have 50% interest

Q78: Mia is a 50% partner in a

Q85: Ben is a 30% partner in a

Q97: Jamahl has a 65% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents