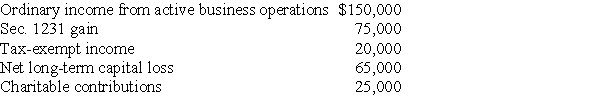

The AAA Partnership makes an election to be an Electing Large Partnership.The partnership reports the following activities:

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: On July 1,Joseph,a 10% owner,sells his interest

Q89: Longhorn Partnership reports the following items at

Q91: How does an electing large partnership differ

Q93: Lars has a basis in his partnership

Q95: Marlena contributes property having a $30,000 FMV

Q98: Oliver receives a nonliquidating distribution of land

Q100: James and Sharon form an equal partnership

Q1210: At the beginning of this year, Thomas

Q1212: Marisa has a 75% interest in the

Q1225: Explain the difference between expenses of organizing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents