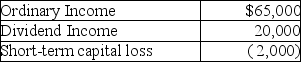

Bryan Corporation,an S corporation since its organization,is owned entirely by Mr.Bryan.The corporation uses a calendar year as its taxable year.Mr.Bryan paid $120,000 for his Bryan stock when the corporation was formed on January 1 of this year.For this year,Bryan Corporation reported the following results:

Distributions of $40,000 were made during the year.What is the basis of Mr.Bryan's stock on December 31?

A) $163,000

B) $165,000

C) $203,000

D) $205,000

Correct Answer:

Verified

Q107: Which of the following characteristics can disqualify

Q121: For each of the following independent cases

Q121: Raina owns 100% of Tribo Inc.,an S

Q122: New business owners expecting losses in the

Q123: An S corporation distributes land to its

Q124: S corporation shareholders who own more than

Q128: Empire Corporation has operated as a C

Q131: Which of the following statements regarding voluntary

Q132: Tony is the 100% shareholder of a

Q137: On January 1 of this year (assume

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents